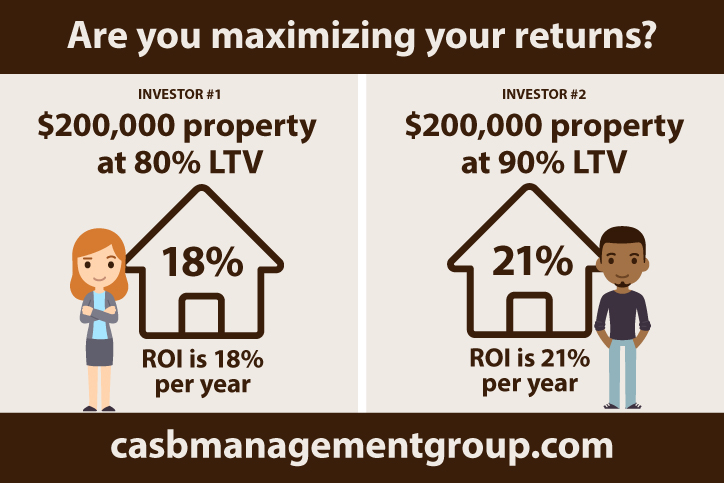

Private lending is a great tool to maximize real estate returns. Typically you can only finance up to 80% LTV (loan to value) on a rental property with traditional lenders. By adding additional mortgage debt through the use of a second mortgage, it is possible to leverage properties up to 90% LTV and beyond. This may be advantageous for investors. I was challenged to prove this formula actually works. Don’t take my word for it, do the math. I am providing you a simple example but you can use your own numbers and decide if additional leverage is right for you.

Investor One

Purchased a $200,000 property at 80% LTV. First mortgage of $160,000, 2.1%, 30 year amortization. $600 per month 1st mortgage payment. Rent of $1500 per month less $300 for property tax and insurance, net of $1,200 per month before financing, $600 per month after financing. Cash flow of $7,200 per year. Based on the $40,000 initial investment your return on investment is 18% per year.

Investor Two

Purchased a $200,000 property at 90% LTV. First mortgage of $160,000, 2.1%, 30 year amortization. Second mortgage of $20,000, 15%, interest only. $600 per month 1st mortgage payment. $250 per month second mortgage payment. Rent of $1500 per month less $300 for property tax and insurance, net of $1,200 per month before financing, $350 per month after financing. Cash flow of $4,200 per year. Based on the $20,000 initial investment your return on investment is 21% per year.

Investor two outperforms investor one returns by 16.7%. Investor two has increased their capacity to purchase additional properties by 100%. What is stopping you from maximizing your returns? We are here to help provide you with creative financing options using the concepts of leverage and private lending.

Recent Comments